Somewhere around the age of eight or nine, I stumbled across a book that would change my life.

This book was small and purple-ish in colour. It had a fun sounding name.

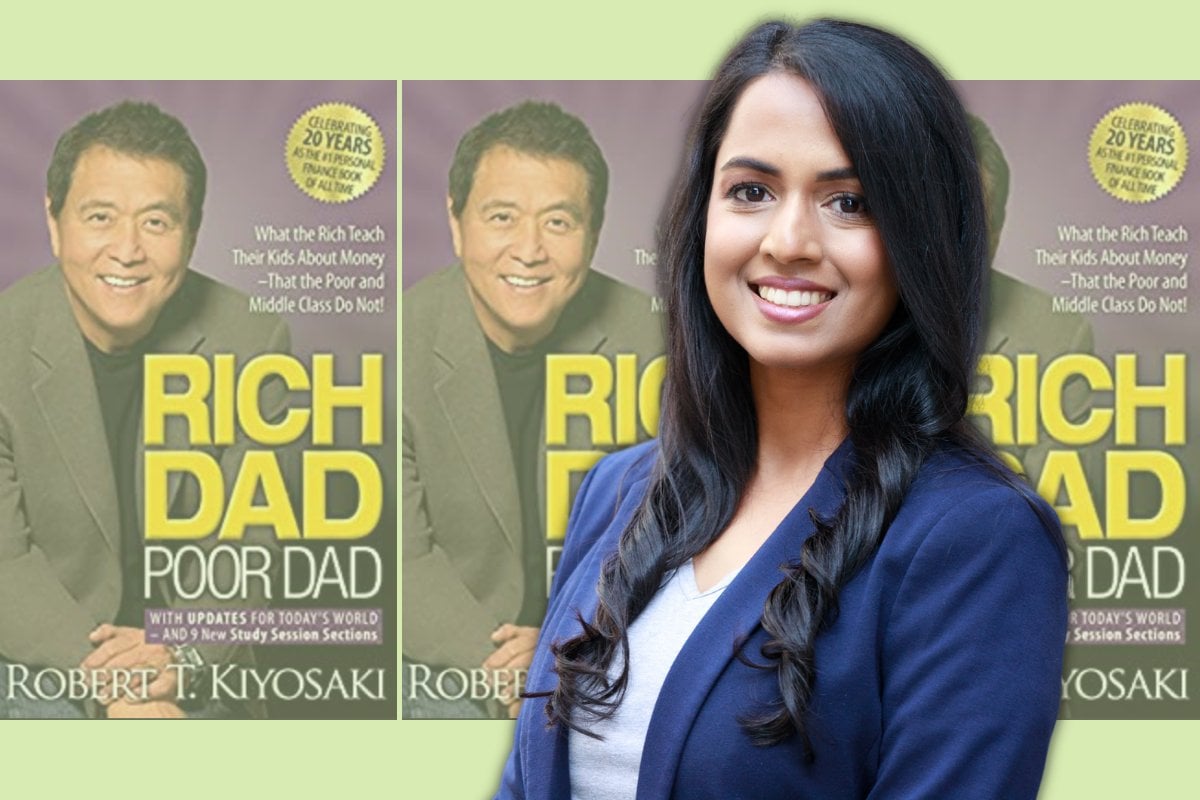

Rich Dad, Poor Dad, by Robert Kiyosaki.

Honestly, I thought it was a fiction book. I had no idea what it was about.

I also had no idea that one day, inspired by this book, I too would become a financial educator.

Watch: 5 money lessons your parents told you, that you should probably forget. Post continues after video.

Today, I run a financial education platform helping people take control of their finances. Today, hundreds have transformed their financial lives through our flagship course, Mastering Money.

But the one thing I could never have even dreamed of all those years ago, was that one day I would interview the author of that little book.

During the height of the pandemic, I had the opportunity to ask Robert Kiyosaki all of my burning question, live.

If you have any interest in personal finance, you’ll know that Kiyosaki is a ‘big deal’. Back in the 90s and 2000s, Kiyosaki was an international ‘finfluencer’ way before it was cool.

Top Comments