About six million Australians are set to benefit from a $1500 wage subsidy after the Government’s JobKeeper legislation passed Federal Parliament on Wednesday.

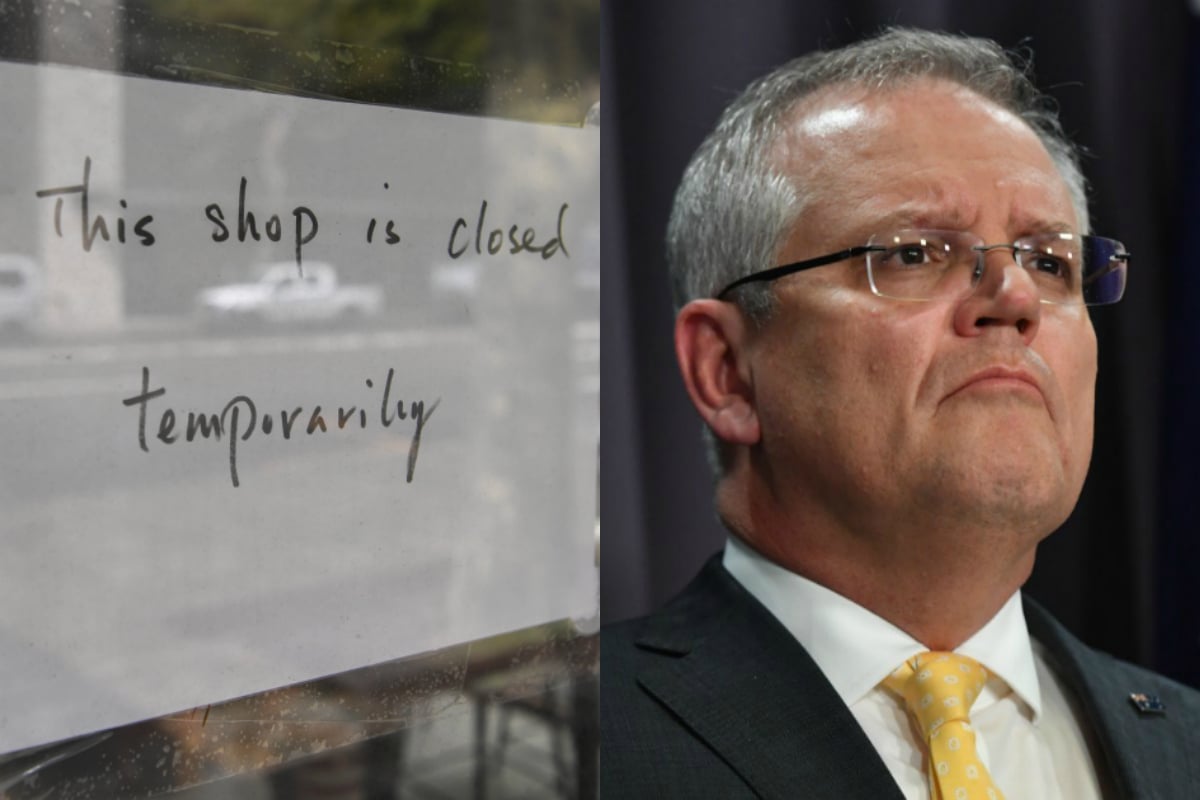

In late March, the federal government announced the $130 billion support package to help Australia cope with the economic crisis that has unfolded because of the coronavirus pandemic.

Australian Prime Minister Scott Morrison said it was the biggest economic package Australia has seen in its history, and more than 730,000 businesses have registered for access to the scheme since its announcement.

The ‘job keeper’ payment of $1500 per fortnight will see the government pay employers to pay their employees.

Listen: What four Australian healthcare workers want you to know about COVID-19.

This will ensure Australians can keep their jobs even if the work cannot continue because of the coronavirus crisis, the Prime Minister said.

“We want to keep the economy running through this crisis, it may run in idle for some time, but it must run,” Scott Morrison said during the press conference.

The Opposition backed the legislation after its amendment to expand the payment to include 1.1 million more casual workers and temporary visa holders failed.

Treasurer Josh Frydenberg said a “line had to be drawn” by the Government at some stage, when discussing support for workers.

Here is what you need to know about eligibility for the JobKeeper payment, and the JobSeeker payment announced in March.

Top Comments

I work on average only 7 hrs a week and have been working at my job for 9 years. I am assuming I would be eligible? Which I think is ridiculous considering my take home pay is waaaaay less than that. I don't think I could apply with a clear conscience.

It's complicated. Don't know where you work of course, but your employer would have had to have seen a decrease in turnover by at least 30% - 50% (depends on how big the employer is).

I haven't gotten a full briefing yet, but it appears that yes, you wold be eligible despite only working 7 hours a week. If the business meets the above requirements.

Are apprentices covered by this job keeper payment if they are stood down (working full time)?