Saving for retirement is the last thing on everyone’s list of priorities, however with living expenses increasing every year and ongoing market volatility it is important to start thinking 10, 15 and even 20 years ahead.

If you’ve never run the numbers before on packing a lunch versus eating out every day, then you might be surprised how easy it is to save some serious money.

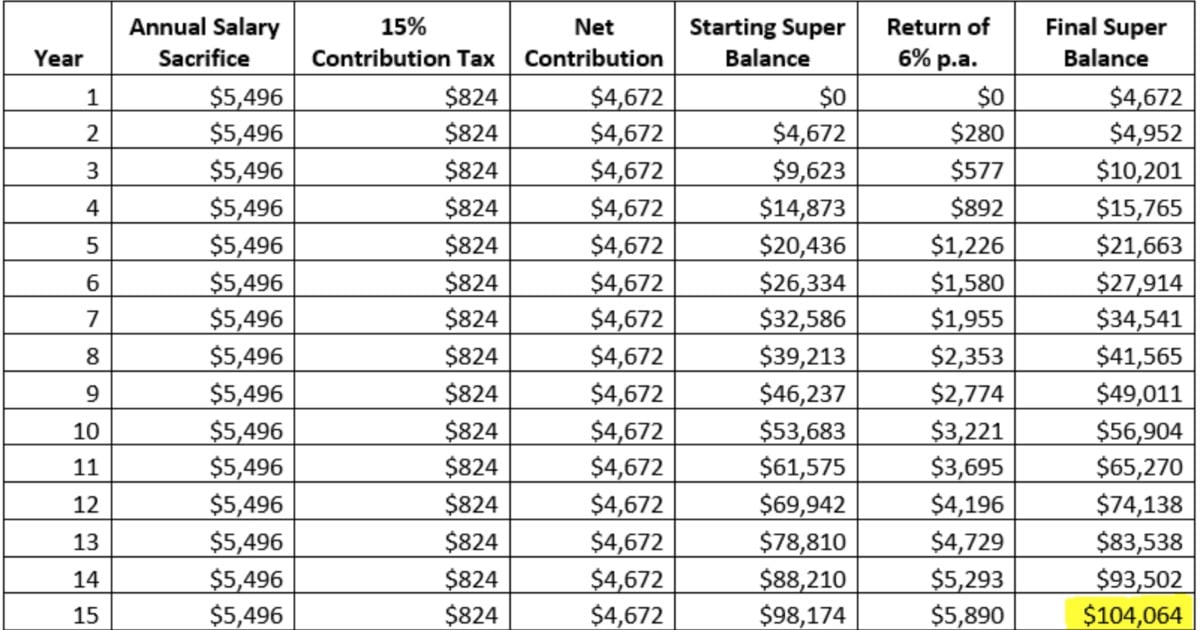

The below table compares spending $20 on lunch and coffee each day versus preparing and supplying this from home at $5 a day and allocating the savings to superannuation via salary sacrifice.

LISTEN: Finance guru Canna Campbell talks about the $1000 Project, and shares her money-saving hacks. Post continues after audio.

A quick summary of the main benefits includes:

- After 15 years there could be an extra $104,000 in your superannuation account (this has assumed a starting balance of zero, so any existing funds have not been included).

- On top of the increasing super balance, there is the added benefit of reducing your personal tax liability each year.

- This is based on tax rates for incomes under $87,000 (if your income is greater than this the savings are even greater!)

- Salary sacrifice is extremely flexible and can be changed or cancelled at any time.

The below table shows the possibility if these funds were salary sacrificed to super each year and how these funds may accumulate over the next 15 years.

Top Comments

I think there's merit in the article. Even if you half the numbers, it does make sense. However, it is also important to live a little for today - after all, we work hard enough. Yes! savings and investing are important to ensure your financial freedom in the future but do we have to cut out all our lifestyle choices just so we can access our superannuation by age 65 or even longer? I guess finding the right balance between maintaining your daily lifestyle expenses and investing for future financial freedom is the key to this.

I'd like to see the numbers on coffee and lunch for $5 per day.