As every mum and dad knows, kids are expensive from the minute they’re born. And although they become more and more independent every year, the darling cherubs also become more costly; bigger and more expensive clothes, more activities, and of course, school.

Anyone who’s been there will agree that making a decision about a child’s education, between public and private, is one of the most overwhelming, and significant, choices parents can make.

It’s not easy. There are so many factors to consider, and so many unknowns about the future, for example, what can you afford? Where will you be living? If you decide private, is it just in junior school, or from the start?

And it’s not just the term fees that make up a child’s education, but their sports, music, uniforms, and excursions – just to name a few things.

If only we all got a crystal ball when the stork delivered our babies…or, at the very least an education costs calculator. But wait – now we’ve got one of those things.

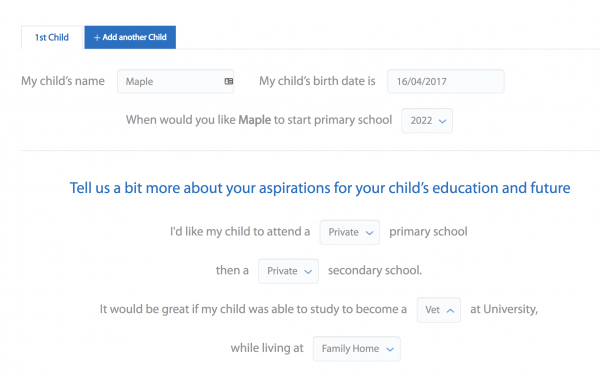

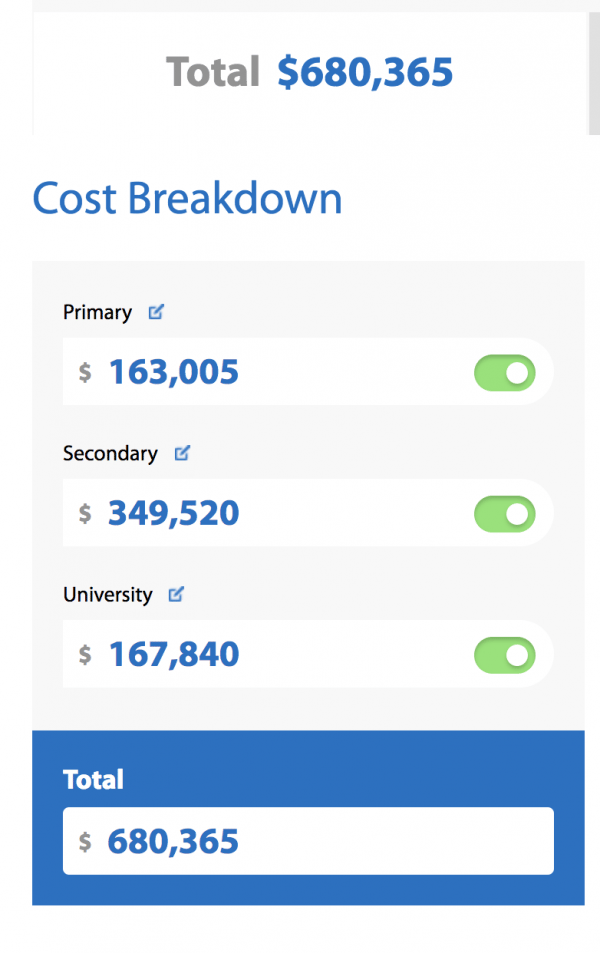

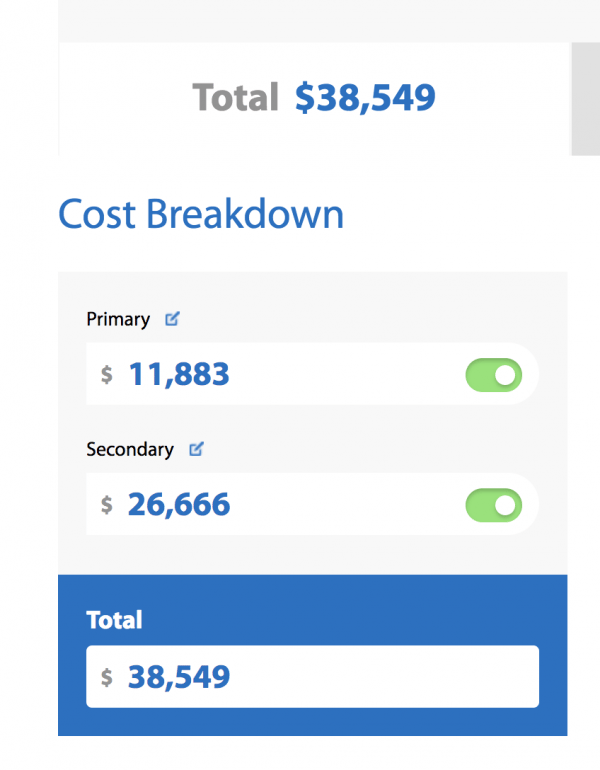

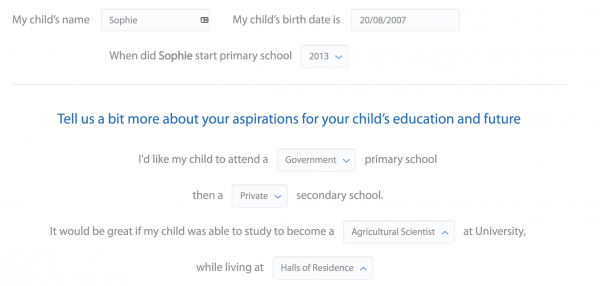

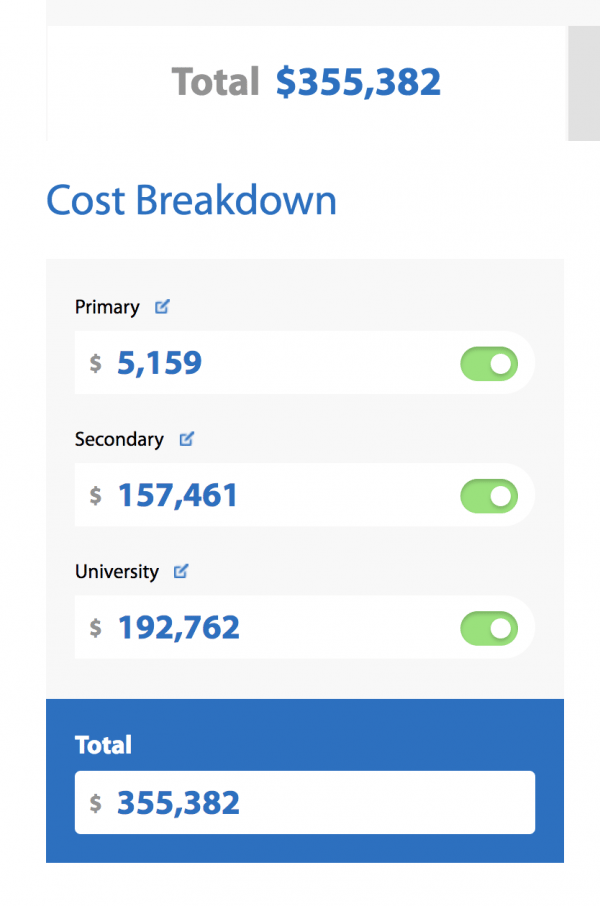

Australian company ASG, which specialises in helping parents plan for their kids’ educational futures, has a “Cost of Education Calculator” on its site, and yes, it’s as easy as it sounds.

It does all the thinking for you, and considers every factor – even the ones you don’t think of immediately, such as the date they will start primary and/or senior school and whether you live in a rural area. Because those things impact the cost of transport, excursions and extracurricular activities.

Top Comments

Quick question how come you've only put in university cost for a child going to private school .

Are you assuming that if you go public you're child isn't going to go to uni?