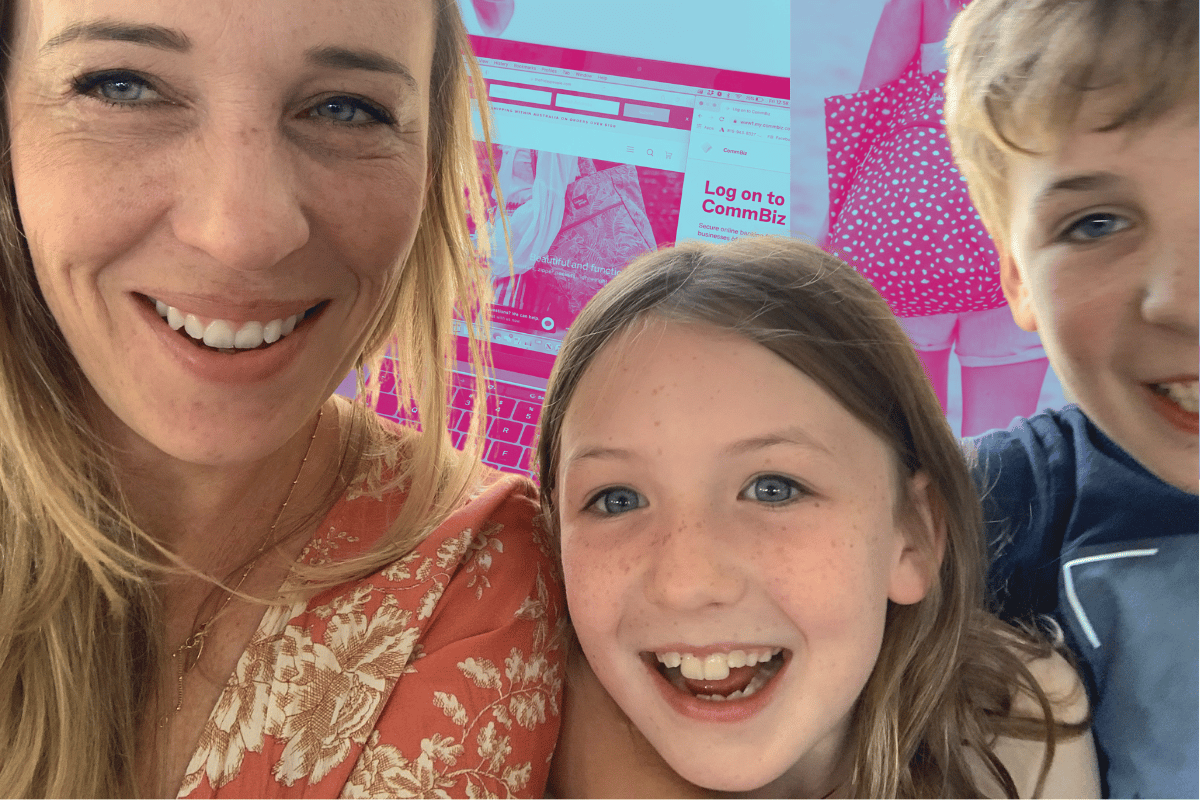

After years of searching, I still couldn’t find the perfect ‘mum bag’ that ticked all the boxes.

I needed a functional bag (and wanted it to be beautiful), and I just couldn't find it. I’ve always wanted to run my own business, so this is the gap in which I started my side hustle.

After a bit of research and a big, nerve-wracking leap of faith, I started The Friday People from my kitchen table in Sydney. The juggle ahead of me was just beginning, as the business was born while I held down a corporate job and juggled managing family life as a mum of 2.

Two years into running The Friday People, it’s been the wildest ride. I’ve learnt so many new skills, met a whole new group of inspiring women in business and I’m proud to role model to my kids that starting a successful business from scratch is absolutely possible.

My business is now growing rapidly in a way I wouldn’t have believed possible sitting at my kitchen bench two years ago.