“Are you still renting? Why don’t you buy yourself a house already. Rent money is DEAD MONEY!”

If you rent, I’m sure you have come across one of these people at least once in your life. And it’s most likely coming from a loved one who genuinely cares about you.

It’s easy to understand how they come to this conclusion, too. At the end of every month you have to fork over hundreds (sometimes thousands) of your hard earned dollars for nothing more than the privilege of having a roof over your head. If you were to buy a house however, at least your payments are going towards something you can call your own. That’s the common theory amongst the vast majority of Australians (especially parents) at least.

If you have the deposit ready, is it always better to buy than to rent?

Why you should buy:

Let me just make one thing clear before we delve into this debate. I’m going to be looking at this purely from a financial point of view. There are many intangibles that come from buying a home that you can’t measure in dollars. Your home is your castle that you raise your family in. There is an emotional attachment when buying a home which varies greatly from person A to person B.

I personally only really see one major benefit from buying a house to live in.

Security

It’s a pretty major benefit, too. When you rent you are always at the mercy of the landlord. Rent could be raised at the end of your lease. Leaky pipes may never be fixed. You’re not allowed to buy a cat because it’s against the rules. And what happens if the landlord decides to sell to home owners who want to move in and kick you out? You have to find another place to live, and anyone who has ever moved or helped move someone can attest to how frustrating that is.

Top Comments

You can’t really compare renting over 30 years to interest over 30 years because a life of renting is more like 60-70 years. It doesn’t end after 30 as your article implies.

Good theory until you retire and spend most of your money on rent. If you haven't been able to save for a house deposit, then it is unlikely you will have enough stashed away when you quit work.

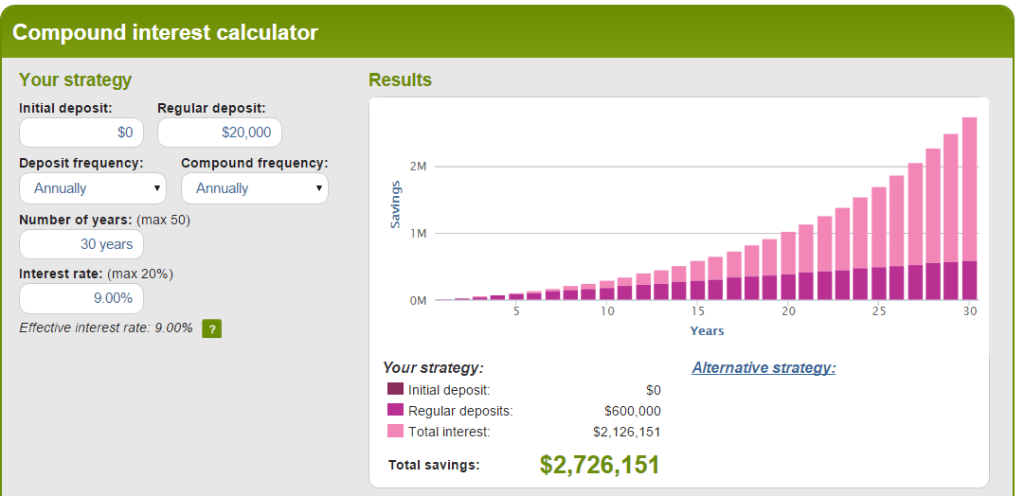

The theory is that you invest the cost differences between renting and owning; and after 30 years your investments will be worth much more than a home.

Agreed, and that is the stage of life when most have their greatest medical and care costs.