We're not exactly out of the woods just yet when it comes to the pandemic, but my goodness we've come a long way since the start of 2020.

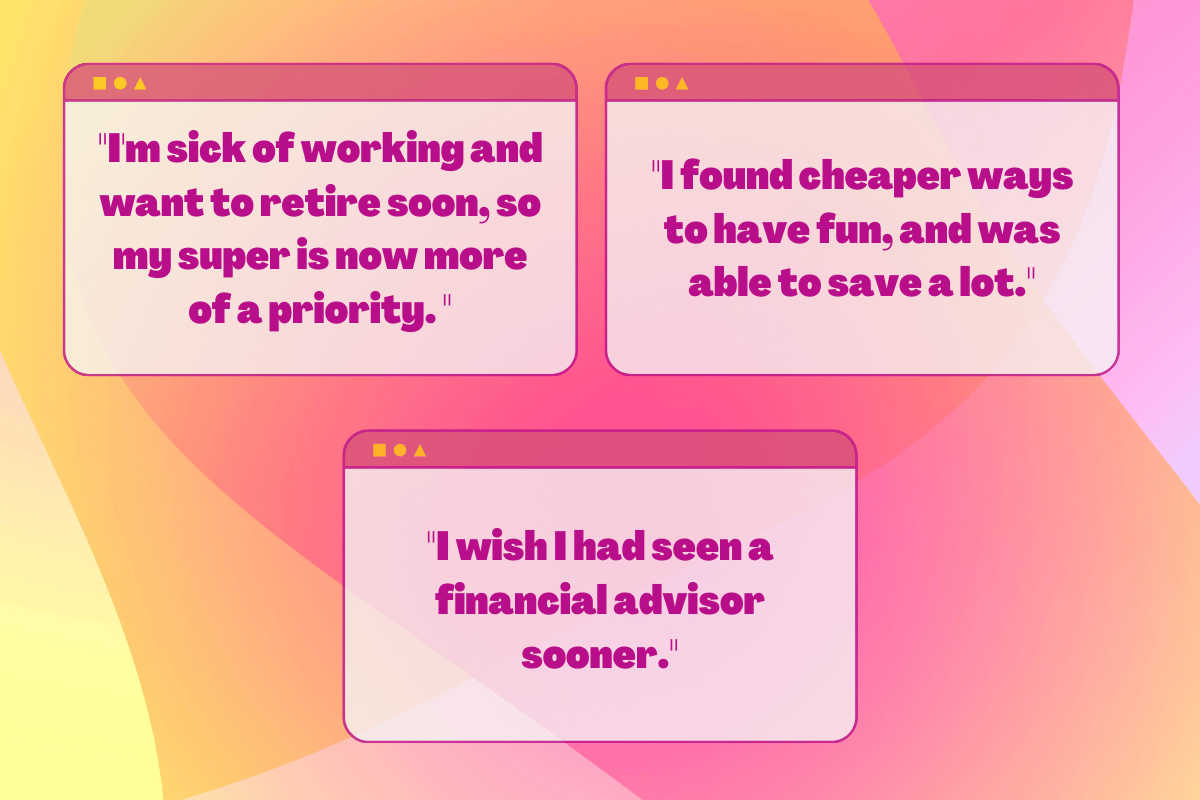

Two years down the track, there's been a multitude of money lessons learnt, whether it be to do with saving, investing, emergency funds, fun purchases and more.

Recently, Mamamia conducted a money survey, where we asked Australian women all about their finances.

Watch: Ladies, Let's Talk...money! Post continues below.

We asked how much they have in savings, how much they spend, what money advice they actually follow, and much more.

And this week, we're unpacking one of the questions that had the most varied responses.

How has the pandemic changed your stance with money?

1. "It changed my stance completely. After I lost half of my salary in 2020 because of COVID-related job cuts, I realised how unhealthy it was to tie my income and job to my self-worth. I felt defeated and not at all valued, it really shook my confidence."

2. "I'm spending a lot less than I used to pre-pandemic. I feel less stressed about my finances and less likely to overspend when I'm out with friends. I know my limit with spending."