Just like lots of people do, when I first started thinking about creating my small business That Budget Stuff, I had a mental picture of how it would work and how much time I would need to devote to it.

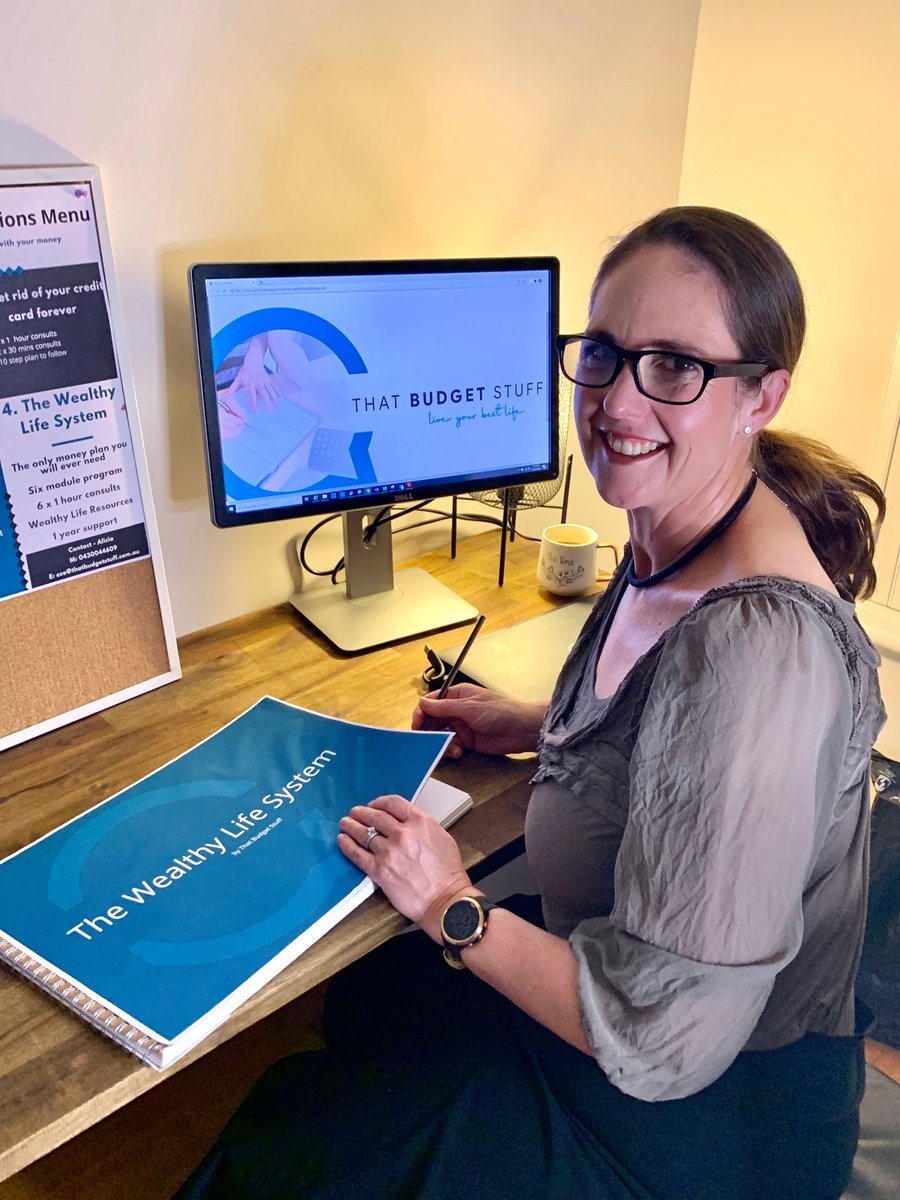

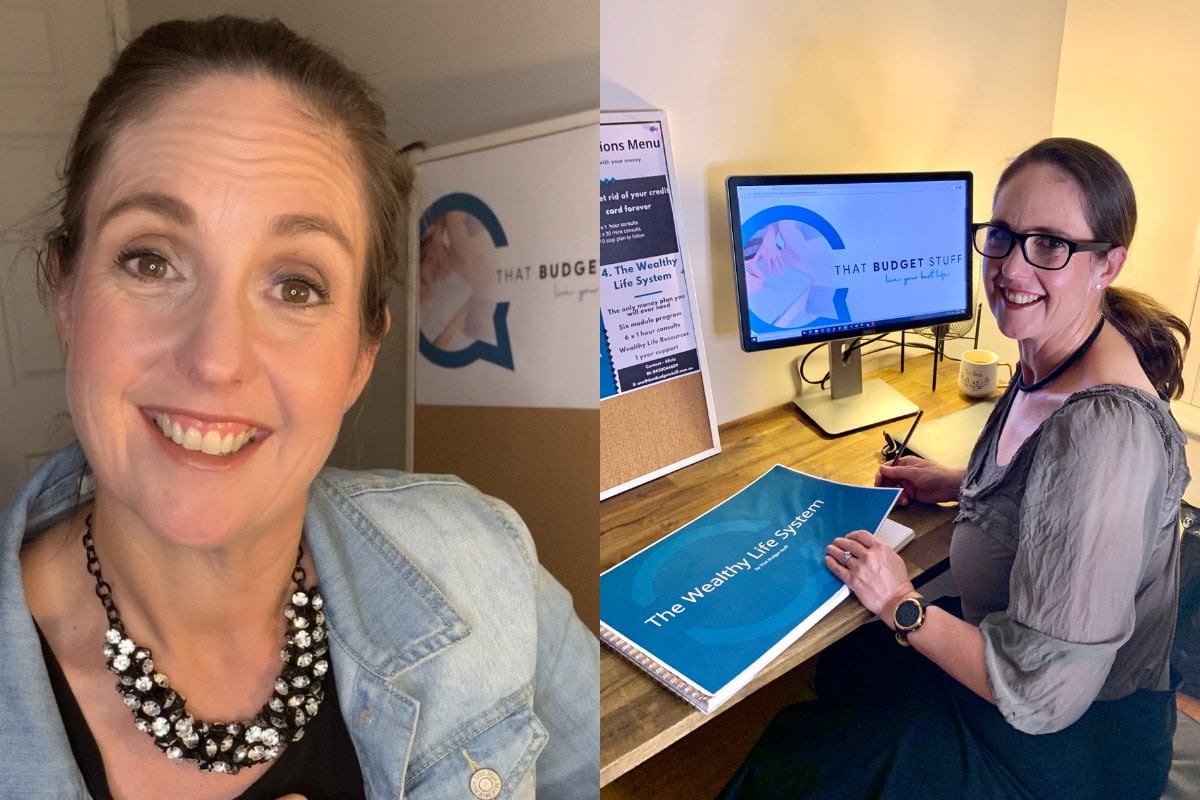

My business is all about wealth coaching: getting people on their best money path, setting financial goals for growth and security, budgeting and also tracking their success.

I needed to be really clear on what it would take to make my business thrive, as I had another important factor to take into account – my full-time job.

And when I say 'job', I mean my career.

Up until that time I had put lots of effort and energy into establishing my career and it was my main source of income, which I needed to maintain until my side hustle was generating enough money (I'm sure many Lady Startups can relate).

I quickly realised, to be able to set up a small business whilst working full-time, I needed to be on top of a few things.

Here are the ones I always tell other people.

I needed to be organised.

For me, this meant having a step-by-step process to follow.

And there is no better system to follow than a tried and true one. I completed the Lady Startups Activation Plan and this took me through the steps to get my side hustle off the ground.

Straight after this I started to document my side hustle journey online. I even set up an Instagram page for this as well as an Instagram page for my core business, That Budget Stuff.