All I wanted was free money.

That's all.

Just money for doing nothing.

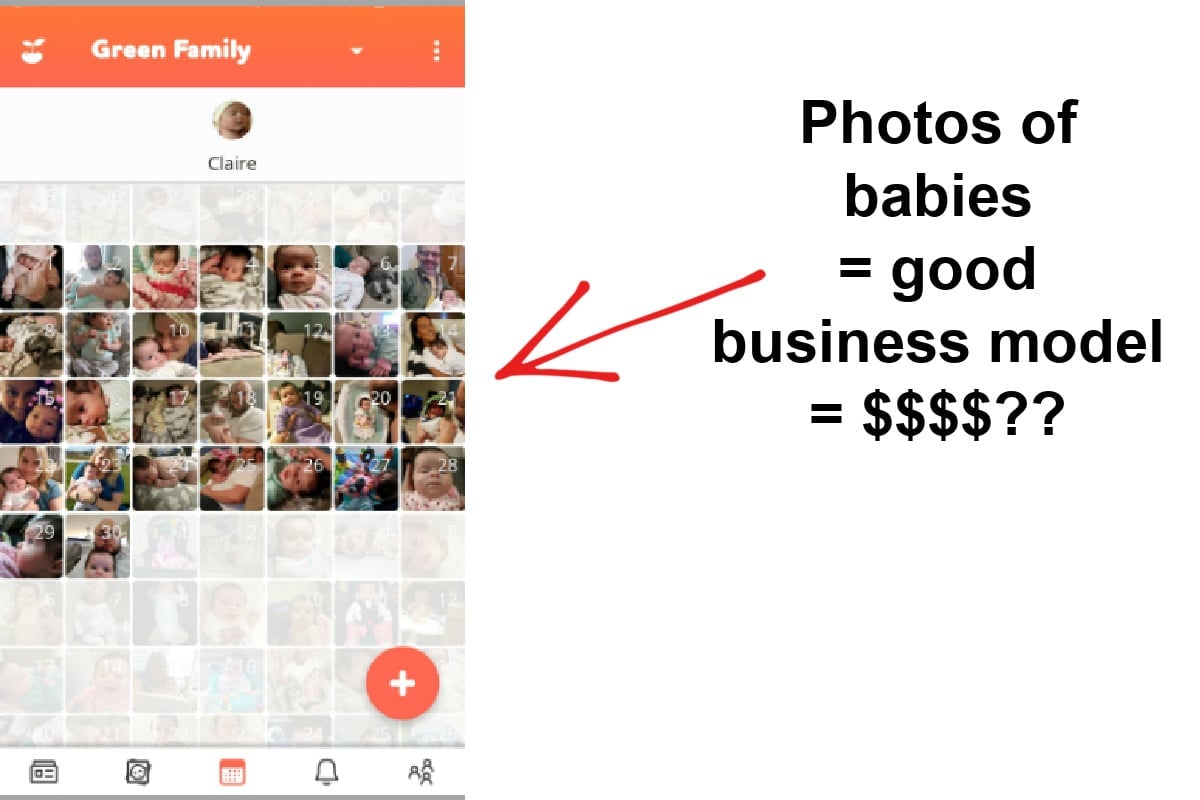

I figured that given I spend a ridiculous number of hours on my phone, if I could convert a small amount of that time into using an investing app, it might translate into cash moneys (rather than low self-esteem/attention-span issues like everything else I do on my phone).

Rich people are always talking about investing, and recently, they've been using a word I didn't (and to be honest, still don't) understand: crypto.

Cryptocurrencies are digital money that can be used to buy goods and services, or be traded for profit. They're not issued by a bank, and aren't regulated, which means the market can be volatile. But we've all heard the story of that guy who bought one bitcoin in 2009 which is now worth millions.

So why can't I be that guy?

Also, why is it always a guy? I'll tell you why. Because women are socialised from the moment we're born to have a very different relationship with money to men. We're not spoken to about money in the same way, we're risk-averse, the investment world feels like an 'old boy's club' (because it... is), and before we know it, the men our age are in WhatsApp groups chatting about stocks and I DON'T EVEN KNOW WHAT A STOCK IS.

I don't remember agreeing to this double standard.

I don't remember agreeing to this double standard.

Top Comments