When it comes to finances, we may be getting slightly better at talking about things like investments, savings and salaries with our friends, but how many times has a pal shared the exact dollar value sitting in their bank account?

Our bet: Zero times.

But that is all about to change. Because the Mamamia Money Survey has opened up that can of worms in a big way.

Watch: 4 money hacks that don't cut out your daily cup of coffee! Post continues after video.

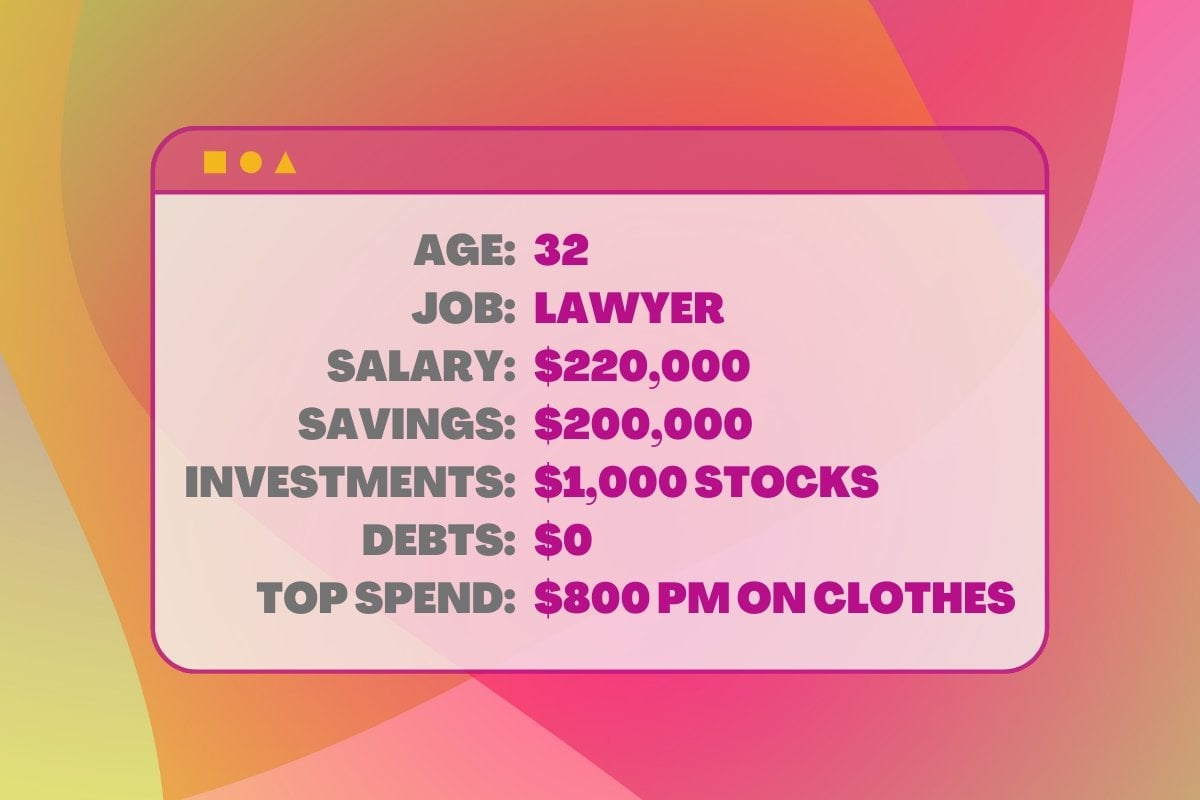

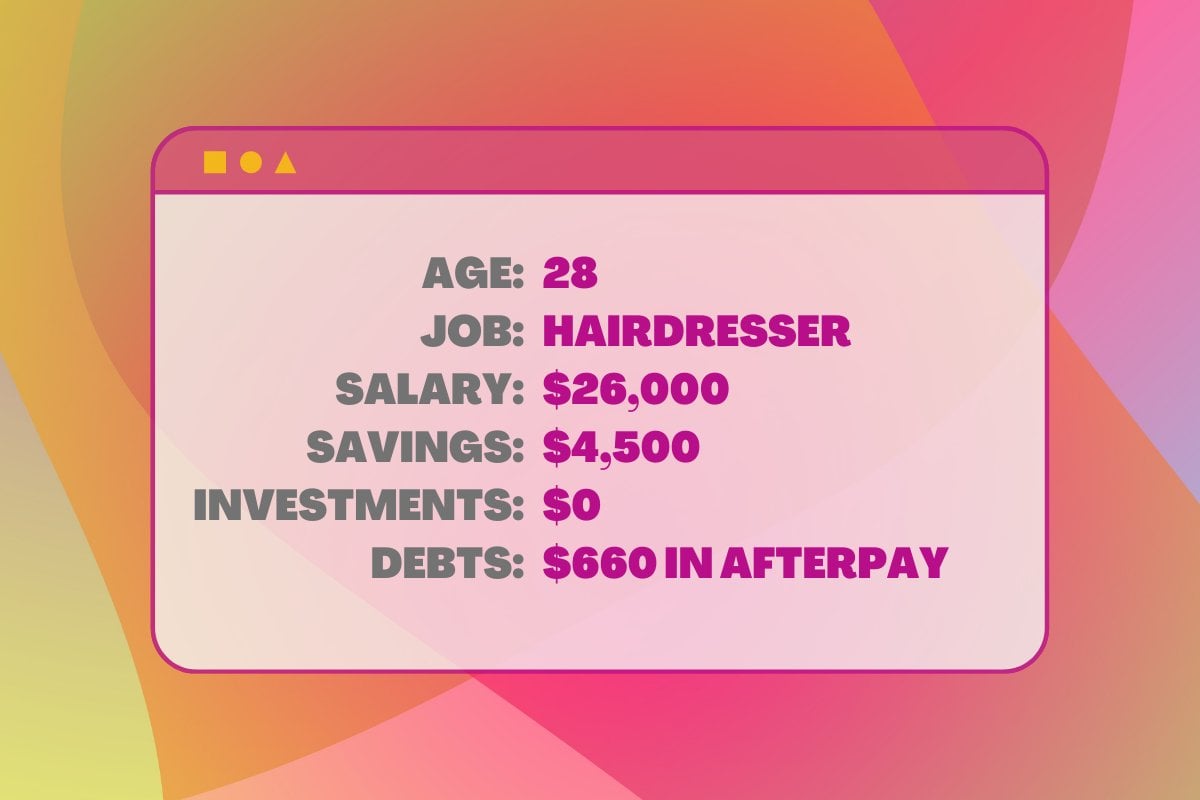

Yep, we asked women how much they have in their savings account right this very second, and they shared. Totally candid anonymous amounts, paired with a little intel on their income, debts and lifestyle so we can piece together a pretty complete picture of where they stand financially.

Here's what they had to say.

How much money do you have in savings?

A 33-year-old lawyer working in the resources industry earning $111,000 per year, currently has $90,000 sitting in her savings. She is living in a share house and tries to add $2,000 into her savings each month, but she's also paying off her remaining $14,000 of HECS/HELP debt.

A 20-year-old assistant working in the media industry earning $55,000 per year, currently has $8,222 sitting in her savings. She admits that she probably spends too much on nights out and should commit more to chipping away at her $73,657 of HECS/HELP debt.

Top Comments